Key Benefits of Focusing on Post-Shipment Trade Receivables Management

1. Pre-shipment

Once a buyer places a purchase order, the supplier initiates the production of the goods ordered. This crucial pre-shipment stage ensures that all specifications and requirements are met before dispatching the products to the buyer.

2. Post-shipment

After production, the supplier arranges for the shipment of goods. Subsequently, an invoice is issued to the buyer detailing the transaction. During this phase, the risks related to suppliers, such as performance risk, are typically marginal, ensuring a smooth transition to delivery.

3. Check, Deliver & Pay

Once the goods are received, the buyer verifies their quality and approves the invoice. Following approval, the buyer disburses the funds to the supplier. This methodical approach significantly reduces the risk of fraud, ensuring a secure and trustworthy transaction process.

Transforming Trade Receivables

Characteristics of trade receivables make them a unique and attractive asset class

Characteristics

Attractiveness

Global Reach, Local Impact

Bridge the $2.5T trade finance gap with opportunities across industries.

Quick Cycle, Quick Returns

Turn investments around in 60-90 days—fast, efficient, effective.

Diverse Streams, Consistent Gains

Tap into a wealth of corporate credit from varied sectors.

Risk-Smart, Return-Ready

Protect against credit shifts and optimise for market re-pricing.

“Trade finance therefore has all the components that investors look for. It is a multi-trillion dollar asset class based on the flow of physical goods and services, making it less susceptible to financial market volatility. Default rates for trade finance products are generally lower and the time to recovery in case of default tends to be shorter than for other credit products”

Benefits Of Investing Through Olea

Risk Management

Risk management is intrinsic to Olea’s service offering and Olea manages risk for all assets agnostic to the asset destination.

Bank-Grade Risk Assessment And Monitoring

Transactional risk management leverages Standard Chartered Group’s expertise in supply chain risk, client due diligence and predictive risk modelling

Robust Governance

As an organisation, Olea ensures governance through an Enterprise Risk Management Framework with three lines of defence and defined accountabilities.

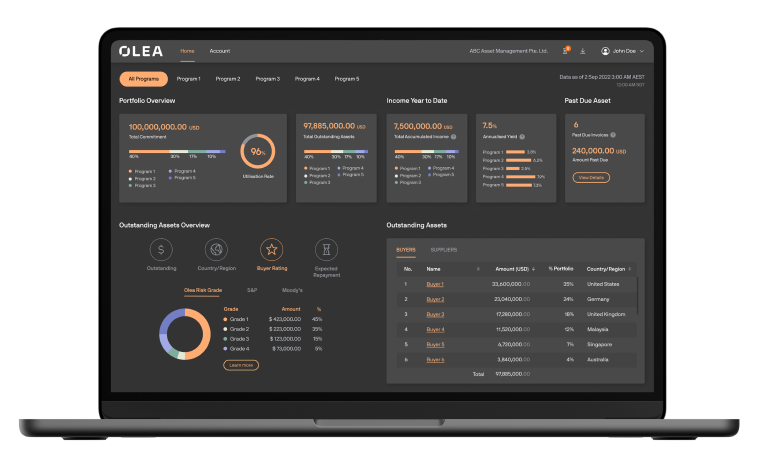

Investor Portal

Olea’s Investor Portal delivers secure, digital transactions with real-time monitoring and risk reporting. The programmatic approach empowers funders to customise their credit appetite and investment characteristics, streamlining transactions for maximum impact.

Key Features of Investor Portal

-

Interactive view of utilisation, yield, and income across programs

- Outstanding portfolio breakdown to jurisdiction/ buyer ratings

- Historical volumes

- Repayment schedule

- Exposure breakdown by obligor